Future Hydrogen War Between Europe and Russia

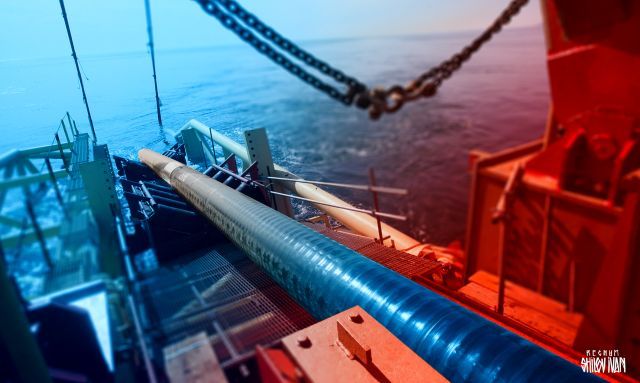

This post is part of a series on humans' crisis relationship with the natural world. The protracted war over the second “Nord Stream 2” line caused an active discussion of a question: even if the Russian pipe can be completed, will they be able to pay for it? The question is not as unexpected as it might seem. $8 billion has been invested into the project. Overcoming the economic consequences of the sanctions, which caused the shutdown of work less than 200 km from the coast, will require some more money. According to expert estimates, up to 500 million, which brings the total cost to the mark of 8.5 billion. At the design stage, it was assumed that the pipeline would steadily pump 55 billion cubic meters of gas per year. At an estimated rate of $2.1 per 1,000 cubic meters per 100 km, the pipeline was expected to generate 1.42 billion in annual revenue. With the average profitability of such projects at 60%, the book profit was at the level of $850 million. This resulted in a 10-year payback period for the project. Everything would have been fine, but there was a problem with the future. And not at all from the field of climate change. Well, let’s say that the demand for gas in Europe will fall by a third due to a decrease in heating demand. This will just shift the payback point back another three years. So what? The Yamal-Europe gas pipeline has been operating normally since 1999. The Ukrainian pipe (which is Urengoy-Pomary-Uzhgorod) was put into operation even earlier — in 1983. Thirty or forty years of operation for the gas pipeline is not a problem. So pushing back the timeframe of breaking even by plus or minus a couple of years is a problem only for the accounting department and bank clerks responsible for returning customers’ loans. But this is within the framework of the ideas that prevailed until recently. Since 2018, the European Union has announced the so-called “green hydrogen strategy”. Without going into details, the concept looks simple. Maintaining, and especially developing industry and meeting the needs of households, require large amounts of energy. In 2019, Europe’s total demand was 1.44 billion tons of so-called oil equivalent. Their own sources cover only a third, and even those will be exhausted by 2030. To avoid becoming critically dependent on external supplies, Europe needs to find an appropriate alternative. This is considered to be hydrogen. For example, a hydrogen-methane mixture can be successfully fed to heat turbines and power plants, and hydrogen fuel cells can be used as energy sources for all types of transport. It is important to note that hydrogen does not have a carbon footprint, thus allowing to comply with current environmental requirements. The raw material for the production of hydrogen can be sea water, whose reserves are considered unlimited, since the burning of hydrogen leads to the return of water to nature. And the necessary energy for electrolysis is supposed to be obtained in a “green way” thanks to the sun and wind. In total, this should completely eliminate the EU’s need to import all types of energy, including Russian gas. And this is not a fantasy in popular science magazines, but a seriously promoted strategy. In the spring of this year, 11 leading gas infrastructure companies from nine EU countries submitted to the European Commission a strategic plan called “European Hydrogen Backbone”. In accordance with it, from the mid-2020s to 2030 inclusive, it is planned to organise “hydrogen valleys” (places of hydrogen production) connected to hydrogen consumers by a system of pipelines with a total length of 6800 km. Over the next decade, by 2040, the infrastructure for transporting hydrogen in Europe should expand to 23,000 km, of which 75% will be converted existing natural gas transmission lines, and 25% – new sections. Thus, by the early 2050s, Europe intends to build two parallel gas transmission networks: hydrogen and biomethane, covering at least 80% of the EU’s energy needs. With the prospect of reaching 100% by 2050-2055. If the project is successful, the market capacity in Europe for Russian gas will be categorically reduced. No one can give exact figures, but in general, experts agree that instead of the current 190 billion cubic meters per year, it will be good if it will be possible to sell 20-30. If not less. Therefore, there is no need not only for the Ukrainian and Polish logistics corridors, but also for the “Nord Stream 2”project, whose payback will move far beyond the horizon of any predictable events. And if so, is it worth spending on completion, is it not easier to admit defeat now? However, as they say, let’s count. To start with, let’s assume that the initiators of the idea of “green hydrogen” will really succeed. There will be money for electrolysis plants. According to the plan, there should be water electrolysis plants with a power consumption of 6 GW by 2024. With an output of 40 GW by 2030 on the territory of the EU and the same amount in neighbouring countries. There will be land for them. There will be owners of power plants who are willing to invest in the modernisation of generation for a hydrogen-methane mixture. We will also be able to successfully resolve operational safety issues. What does mathematics say about this? In general, there are five proven technologies for producing hydrogen in the world today. The most expensive is from biomass. It gives the cost price at the level of $5-7 per kilogram of finished hydrogen, with the prospect of possible reduction to $1-3 sometime in the future. Next in cost is the method of electrolysis from water. But here everything is ambiguous. If you use electricity from the industrial network (at least half created by burning cheap natural gas), the product is obtained at $6-7 per kilogram. In the future, it is possible to reduce the price to 4. If to take wind generation, then $7-11 now and perhaps $3 in the future. With solar panels, the situation is even worse: from $10 to $30 — at present, with the prospect of reducing to $3-4 as the technology improves. A separate type is considered to be a variant using nuclear power. Like for the option of water electrolysis, like for high-temperature electrolysis of other types, it is already possible to get hydrogen at the output of $2.33 per kilogram. Coal gasification and natural gas decomposition are alternatives to water and biodegradation. Although the methods are considered separate, they are based on a similar process – heating without oxygen. In the case of coal – up to 800-1300 degrees celsius, in the case of gas (more precisely, a mixture of water vapour with methane under pressure in the presence of a catalyst) — up to 700-1000 degrees. The gas option is now the most common. It produces more than half of all hydrogen now. At the current level, the cost fluctuates in the range of $2-5 per kilogram, with a real possibility of reducing to $2-2.5 in the future. Coal today is also sufficiently used and even seems more attractive, since it provides $2-2. 5 already now. With the prospect of up to $1.5, including delivery and storage. But there are problems with waste disposal. However, if there is enough desire, it is quite solvable. Thus, a very interesting picture appears. Today, it is most economically feasible to obtain bulk hydrogen from natural gas. It will cost around $2 per kilo. The development of wind and solar “themes”, even in the most optimistic case, will not lower the price below $3. at the same time, the optimists of the idea proceed from the possibility of bringing the cost to $1. Let’s say they can make a fairy tale come true, then what? There is a long and repeatedly proven coefficient of conversion of hydrogen to British thermal units through the heat of combustion. Based on it, it turns out that $1 per kilogram of hydrogen corresponds to the price of $7.4 per million British thermal units (BTU). It is from this moment that there is an association with the famous saying “the devil is in the details”. Even in the period before the heating season of 2019/2020, when gas in Europe costs an average of $7.2-8.1 (per BTU), the transition to hydrogen means a 2-3-fold increase in the cost of primary energy. And if by the “green” option itself, then at least by an order of magnitude. Now, due to the overproduction crisis, gas prices at European hubs have fallen to the level of $2. In terms of hydrogen, this means 27 US cents per kilogram, a price that is absolutely unattainable even in the most distant and optimistic future. Brussels will be able to compensate for some of the difference by introducing “carbon” taxes on energy imports. But the bill here in any case will be a few percent, not multiples more. In particular, because otherwise the meaning of the export itself will disappear. However, in any case, European restrictive measures will play against their own European economy, which is forced to live in conditions of extremely expensive energy. And since, especially in high-tech products, the share of energy costs is a significant part of production costs, the cost of European industrial goods will become uncompetitive in relation to countries with cheaper energy. Thus, Europeans themselves are encouraging the expansion of Russian import substitution in areas where we are currently losing out to the Europeans. First and foremost, in the middle of mechanical engineering, machine tools, and equipment for industrial material processing. How quickly it will start depends on two things. Firstly, the actual timing of Europe’s introduction of cross-border carbon taxes (in fact, the usual import duty, except with a nice new-fangled name). Secondly, it depends on how long Russia will agree to just give Europe €6 to 50 billion a year under this sauce. However, Moscow also knows how to calculate prospects. If Brussels is so eager to get hooked on hydrogen, and even intends to pump it “through the old” pipes, then Russia is quite able to make Europe an “interesting offer”. The Ministry of Energy of the Russian Federation has prepared its own plan for the development of hydrogen energy. Gazprom, NOVATEK, and Rosatom are going to jointly produce clean fuel. The first two provide raw materials and logistics, and the third partner will provide a lot of very cheap energy. Thanks to this, Europe will be able to get ready-made hydrogen from Russia again five times cheaper than its own production in Europe itself. But these are still forecasts, although not so far in the future. Talk about hydrogen in Europe is initiated more by politicians than by serious industrialists. Another question – how sane people there will be able to stop the growth of a wave of hysterical green populism – does not yet have an exact answer. Let’s see. APPENDIX According to most of American people if this happens in the #US they can be defined as "thugs", if this happens in a country where the #US is sponsoring a regime change they can be defined as "courageous freedom fighters". https://t.co/n0x9UI2H8C — Enrico Ivanov ☦️ (@Russ_Warrior) July 26, 2020

By Aleksandr Zapolskis

Meanwhile, this is beginning to be the new normal across the United States of Chaos...

![]()

![]() The Russian Peace Threat examines Russophobia, American Exceptionalism and other urgent topics

The Russian Peace Threat examines Russophobia, American Exceptionalism and other urgent topics