The GM ignition scandal and the case for public ownership

The… sacrifice of human life on the altar of corporate profit underscores the necessity, for the health and safety of the public, of placing the auto industry under public ownership and the democratic control of the working population…”

Shannon Jones, wsws.org

New evidence is emerging on a daily basis of a systematic cover-up by General Motors and government regulators of an ignition switch defect known to be potentially fatal. Reports in the press point to dozens, if not hundreds, of needless deaths resulting from management’s determination to save money and prevent a recall.

There is no doubt that those who drove the more than 2.6 million vehicles ultimately recalled by GM were at risk of death or injury. The ignition switch can be accidentally jarred out of the “run” position, shutting off the engine, power steering and power brakes, and disabling the airbag system. The result is a sudden loss of control of the car, without the benefit of airbags in the event of a crash. A number of the fatal crashes linked to the defect were head-on collisions.

In the midst of the mushrooming ignition switch scandal, GM on Monday recalled an additional 1.3 million cars for an unrelated defect that can result on the sudden cut-off of power steering.

The human cost of the company’s evident indifference is incalculable. Most of the cars involved were low-cost models and many of the drivers were young people. Families will never recover from the sudden loss of loved ones. The cold cash calculus of the company is indicated by the words of a GM project engineering manager who ordered an investigation into the defect closed in 2005 because, according to a report in Monday’s Wall Street Journal, “the tooling cost and piece price are too high” and none of the proposed fixes “represents an acceptable business case.”

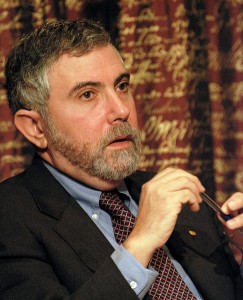

New York Times Blog One of the most frustrating aspects of economic debate since 2008 has been the preference of influential people for stories about our troubles that sound serious as opposed to those that actually are serious. The reality, all along, has been that our economy is depressed because there isn’t enough spending, and that what we need is something, almost anything, that increases total spending. But policymakers and pundits want to hear about tough decisions and hard choices, and they just recoil from any suggestion that terrible problems might have easy answers. The most destructive example is, of course, the deficit obsession that almost completely dominated establishment thinking from late 2009 until very recently, and is still hanging on as a source of bad analysis. Yes, many of the deficit scolds were simply using debt panic as an excuse to dismantle social insurance programs. But many fellow-travelers either sincerely believed that we had a fiscal crisis or felt that it was important to sound as if they believed it, because that was the kind of thing people who make tough decisions and hard choices were expected to say. As an aside, I think the same kind of policy machismo was an important reason so many people who really, really should have known better supported the Iraq war. The deficit obsession has faded a bit; but we still have others. And this new EPI report http://www.epi.org/publication/shortage-skilled-workers/ is a useful reminder of the extent to which another doctrine that sounds serious retains a grip on discourse — namely, the notion that we have big problems because our work force lacks essential skills. This is very much a zombie doctrine — that is, a doctrine that should be dead by now, having been repeatedly refuted by evidence, but just keeps on shambling along. EPI presents some very interesting evidence from a survey of manufacturing, but they’re hardly the first to show that the data don’t at all support the skills-shortage hypothesis. And it’s not just labor-associated think tanks or progressives who have rejected the skill shortage story based on the evidence. The Boston Consulting Group did its own study, and the only hints of a skills shortage it found were in unglamorous skilled blue-collar work: By BCG’s definition, only five of the nation’s 50 largest manufacturing centers (Baton Rouge, Charlotte, Miami, San Antonio, and Wichita) appear to have significant or severe skills gaps. Occupations in shortest supply are welders, machinists, and industrial-machinery mechanics. Some readers may recall that when we finally had a really clear-cut example of a skill so much in demand that wages were soaring, the skill was … operating a sewing machine. http://krugman.blogs.nytimes.com/2013/09/30/a-sew-sew-labor-market/ And Eddie Lazear, very much a Republican, looked at the evidence and reached the same conclusion (pdf).http://www.kansascityfed.org/publicat/sympos/2012/el-js.pdf Yet the skills story just keeps showing up in supposedly informed discussion. Again, I think that this is because it sounds like the kind of thing serious people should say. The sad truth is that while disasters brought on by inadequate demand have an easy economic answer — just spend more! — the psychology of policy elites is such that they generally refuse to believe in this answer, and look for tough choices to make instead. And the result is that unless something comes along to jolt them out of that mindset — something like a war — the slump goes on for a very long time. _________________ The Editors say: Economist Paul Krugman is a New York Times columnist and a professor of Economics and International Affairs at Princeton UniversityThe Skills Zombie

March 29, 2014

_________________

Keystone XL: State Department Tells the Environment to Drop Dead

The U.S. State Department appears to be cooking the books in its studies of the Keystone XL Pipeline. Could this be a sign that the Obama administration is preparing to approve a project that potentially could be the tipping point for uncontrollable global warming?

Given President Barack Obama’s “all of the above” energy policy, and the State Department’s questionable assertion that the Alberta tar sands would be further developed without the pipeline, there is no time to lose. Tucked away on page 9 of State’s Keystone XL Pipeline final supplemental environmental impact statement executive summary, is this tidbit:

“The updated market analysis in this Supplemental EIS … concludes that the proposed Project is unlikely to significantly affect the rate of extraction in oil sands areas.”

Were that true, extraction of the Alberta tar sands would still constitute a monumental environmental disaster, but a series of studies indicates that canceling the Keystone XL Pipeline would put the brakes on further development.

The most recent of these studies, issued on March 3 by Carbon Tracker International, finds that the cumulative amount of greenhouse-gas emissions attributable to the Keystone XL pipeline would be approximately equal to the annual carbon dioxide emissions of 1,400 coal-fired power plants. The study states:

“Through 2050, cumulative lifecycle [greenhouse-gas] emissions attributed to ‘KXL-enabled production’ range from 4943 to 5315 million metric tons of carbon dioxide-equivalent. … Cumulative ‘KXL-enabled’ incremental emissions through 2050 are … nearly equal to total U.S. CO₂ emissions in 2013.” [page 2]

The Carbon Tracker International study concludes that the models used in the State Department’s environmental impact statement “appear incompatible” with the goal of holding the eventual rise in global average temperature to no more than two degrees Celsius. Environmentalists and climate scientists widely predict runaway climate change if temperatures rise beyond that point.

The above figure of about five billion metric tons is a conservative estimate. A discussion in Scientific American says another 240 billion metric tons of carbon would be added to the atmosphere if all the bitumen in the Alberta tar sands were burned, and that all the oil that could be recovered today under current technology represents 22 billion tons of carbon. To put those figures in some perspective, the total amount of carbon thrown into the atmosphere by human activity in all history is 578 billion tons — and one trillion tons would bring the world to the tipping point, according to Oxford University scientists who maintain the Trillionthtonne.org web site.

Speeding up global warming

Oil Change International bluntly says it is “shocking” that the State Department ignored the target of limiting global warming to less than two degrees Celsius “despite the fact that even [State’s] flawed models revealed that the carbon impact of the pipeline could equal as much as 5.7 million cars each year.” The group concludes:

“By avoiding any consideration of climate safety, the State Department report is blindingly clear on one point, if only by implication: the Keystone XL tar sands pipeline is not compatible with a climate safe world.”

As it is, human activity is warming the world. The last month in which the global temperature was below the 20th century average was February 1985 and the last year in which the global temperature was below the 20th century average was 1976.

Tar-sands oil requires more energy and water than other sources, leaves behind more pollution, and is more corrosive to pipelines. Extracting it therefore generates more greenhouse gases than ordinary production.

A Scientific American article, “How Much Will Tar Sands Oil Add to Global Warming?,” reports that the “Albertan tar sands are already bumping up against constraints in the ability to move their product” and “the Keystone pipeline represents the ability to carry away an additional 830,000 barrels per day.”

The State Department is attempting to duck responsibility by claiming the tar sands would be further developed without the pipeline, an assertion not necessarily shared by business proponents. A RBC Dominion Securities report says production would be “deferred” without Keystone XL. TD Bank, one of Canada’s largest, issued a report stating that no further oil expansion is possible without more pipelines. The report said:

“Canada’s oil industry is facing a serious challenge to its long-term growth. Current oil production in Western Canada coupled with the significant gains in US domestic production have led the industry to bump against capacity constraints in existing pipelines and refineries. Production growth can not occur unless some of the planned pipeline projects out of the Western Canadian Sedimentary Basin go ahead.” [page 1]

Economic benefits are misrepresented, too

So the pipeline would enable a major boost to tar-sands production — and global warming. It is not only the environmental impact that is misrepresented, however. Pipeline opponents believe that potential economic gains are greatly overstated by the U.S. government and TransCanada Corporation, the company behind the Keystone XL project.

The State Department’s final supplemental environmental impact statement makes big claims for the pipeline:

“During construction, proposed Project spending would support approximately 42,100 jobs (direct, indirect, and induced), and approximately $2 billion in earnings throughout the United States. … Construction of the proposed Project would contribute approximately $3.4 billion to the U.S. GDP. This figure includes not only earnings by workers, but all other income earned by businesses and individuals engaged in the production of goods and services demanded by the proposed Project, such as profits, rent, interest, and dividends.” [pages 19-20]

TransCanada and the American Petroleum Institute go further and claim that the project would create 119,000 (direct, indirect and induced) jobs. A study by the Cornell Global Labor Institute, however, throws cold water on these grandiose assertions. At least 50 percent of the steel manufactured for the pipeline would be made outside the U.S., the Cornell report said, and that, when all effects are calculated, there may be a net loss of jobs. The report said:

“[T]he job estimates put forward by TransCanada are unsubstantiated and the project will not only create fewer jobs than industry states, but that the project could actually kill more jobs than it creates. … Job losses would be caused by additional fuel costs in the Midwest, pipeline spills, pollution and the rising costs of climate change. Even one year of fuel price increases as a result of Keystone XL could cancel out some or all of the jobs created by the project.”

Those burdens will not be borne by TransCanada nor the oil companies, but they will get to keep the profits. Just the way the “market” likes it.

Finance Capital Uses Non-Profits for Privatization Agenda

Why We Are REALLY Beyond the Non-Profit Industrial Complex In the Age of Neo-liberal Monopoly Capitalism

By Danny Haiphong. The Centre for Global Research.

INCITE!, a radical organization by and for women of color, wrote a book entitled “The Revolution Will Not be Funded: Beyond the Non-Profit Industrial Complex.” This important text contains essays from radical scholars, activists, and organizers who assess the non-profit’s place inUS monopoly capitalism. The book concludes that non-profits co-opt and corrupt grassroots social movements that seek to replace monopoly capitalism with a new and just social system. The following essay adds to this important work by covering the ways in which non-profits have changed in US capitalism’s neo-liberal stage of development.

INCITE!, a radical organization by and for women of color, wrote a book entitled “The Revolution Will Not be Funded: Beyond the Non-Profit Industrial Complex.” This important text contains essays from radical scholars, activists, and organizers who assess the non-profit’s place inUS monopoly capitalism. The book concludes that non-profits co-opt and corrupt grassroots social movements that seek to replace monopoly capitalism with a new and just social system. The following essay adds to this important work by covering the ways in which non-profits have changed in US capitalism’s neo-liberal stage of development.

Historical Context

Originally, the tax-exempt non-profit emerged as a response to the revolutionary elements of the Black freedom movement. As Robert Allen explains in “Black Awakening in Capitalist America”, the Ford Foundation and similar “philanthropic” organizations were part of a larger strategy of US Empire to channel the resistance of Black America in the nation’s burning ghettos into forms of protest acceptable to the hegemony of racism and capitalism. The Ford Foundation specifically did this by financing and thus sanitizing the ideological and political initiatives of the Congress of Racial Equality (CORE) and other mainstream civil rights organizations. At the federal level, the US government’s ”War on Poverty” programs worked in conjunction with foundations and non-profits to stifle Black militancy on a larger scale.

“The War on Poverty” used non-profits as the material force of the Economic Opportunity Act of 1964. One such non-profit was the Community Action Agency (CAA). The CAA received federal funds to advocate and organize the poor locally and administer concrete services like food, healthcare, and housing assistance. As the US exited its period of leftist upheaval in the age of industrial capitalism and entered the age of neo-liberal austerity, the rulers of finance capital began retracting “War on Poverty” programs. CAA’s were forced to meet the needs of the increasing numbers of poor and homeless walking through their doors and do so with fewer resources. US government enforced austerity additionally decimated funding for CAA’s, as the US ruling class pursued more profitable projects like gentrification, privatization, mass incarceration, surveillance, war, and bank bailouts. The non-profit’s role was due for a makeover.

CAA’s and the NEW non-profit

CAA’s exemplify the original purpose of the non-profit as a mechanism to smooth over the roughest edges of US capitalism. However, in the age of neo-liberal monopoly capitalism, existing programs that address the needs of the exploited are being rolled back to feed the bottom line of Finance capital. Wall Street has transferred most of the world’s wealth into their dollar schemes. The ultimate goal of Wall Street is to privatize Medicaid, Social Security, public education, and the entire public sector to subsidize its losses and crashes. Non-profits are being employed by finance capital to cement its privatization agenda, thus making the institution not only limiting in nature but thoroughly corrupting as well.

Teach for America (TFA) and LIFT are two non-profits currently serving the privatization agenda. Financial corporations, such as Goldman Sachs, JP Morgan, Bank of America and capitalists like the Walton and Gates families, fund both LIFT and TFA.

TFA demonizes public education teachers and directly aids the Obama Administration’s “Race to the Top” program. TFA replaces veteran teachers with a two-year scab labor force from the nation’s elitist colleges. Most of the time, this is done to school districts residing in Black and brown communities. ”Race to the Top” gives local districts the ultimatum of either closing their public schools, firing their teachers and administrators, turning their schools over to charter schools, or all of the above. Teach for America happily brands itself as a “movement” of “education reform”, one that accommodates Obama’s privatization of public education.

LIFT serves the same function, but in the social services sector. Elitist college students work as “advocates”, a euphemism for de-professionalized caseworkers and social workers. LIFT employs mainly volunteers. Non-administrative staff, the vast majority of employees, is subsidized through Americorps. And like TFA, LIFT demonizes whom they wish to replace: case workers and social workers. Yet the agency strongly claims it provides a better model than the social services system despite having no concrete services of its own. LIFT’s ultimate aim is to exist as a one-stop shop for referrals in a privatized social services system.

Conclusion

The Black liberation movement and left radicalism of the post-New Deal period sparked a strong response from the rulers of monopoly capitalism. COINTELPRO conducted mass assassination, infiltration, and imprisonment campaigns on Black radicals. The US government moved swiftly to end the Vietnam War, prop up a Black misleadership class, and conduct a minimal “War on Poverty” to stem the tide of revolutionary sentiment in the US. Non-profits have played a large role in channeling revolutionaries into comfortable careers that promote liberalism and collaboration with monopoly capital. With no radical movement to co-opt, non-profits are now employed to complete the privatization agenda of finance capital. Teach For America and LIFT are concrete examples of this phenomena. However, Western NGO’s operating in neo-colonial countries should also be considered as being complicit in monopoly capital’s thievery on an international scale.

Liberal and progressives in the US all too often de-politicize the non-profit and separate the institution from its role in larger society. Careerists approve of non-profits in their search for a comfortable salary in the midst of the mass immiseration of the world’s oppressed by neo-liberal capitalism. For those of us whose futures depend on revolutionary change, the non-profit stands at the forefront of our struggle against privatization, austerity, and imperialist war. “Civil society” in this period is a weapon of inequality and plunder. We need to build a grassroots social movement where the people are the power and not the financing of the capitalist class.

Danny Haiphong is an activist and case manager. You can contact Danny at: wakeupriseup1990@gmail.com.

Time Warner CEO to receive $80 million payout after six weeks of work

By Andre Damon, wsws.org

Robert D. Marcus. Why is this corporado smiling? Because he makes money the easy way, he steals it via corporate insider games. His grotesque compensation, like that of his peers in the corporate class, happens at the expense of billions of people who are being driven into or kept in squalid poverty as neoliberalism sinks its claws deeper in most nations around the globe.

Robert D. Marcus, the chief executive of Time Warner Cable, is set to receive an $80 million payout if the company goes through with its planned acquisition by Comcast, the company said in a regulatory filing Thursday.

Comcast announced the deal six weeks after Marcus took over as CEO, meaning he will receive more than $2 million per day for his time as CEO prior to the deal. That is the equivalent of receiving $1,300 per minute during that period.

While Marcus’s compensation—referred to as a “golden parachute”—is not the largest such payout in history, it stands out because of the extremely short duration that he worked at the company.

Executive compensation committees claim that such “golden parachutes” are a means to ensure that CEOs have an incentive to agree to deals that are beneficial for shareholders. In reality, they are nothing more than a of means of awarding CEOs tens of millions of dollars beyond their reported salaries.

Marcus became Time Warner’s CEO and chairman at the start of this year, after being named to replace Glenn Britt, who had served as the company’s CEO for twelve years. Prior to becoming CEO, Marcus served as the Chief Operating Officer at Time Warner, and received $9.9 million in compensation for 2012.

If the merger goes through, Marcus will get $45 million in stock and $20.5 million in cash as well as a potential $2.5 million bonus. The deal is dependent on the merger getting the approval of the White House, but commentators and analysts expect little opposition to the proposed merger on the part of the Obama Administration.

Other Time Warner executives are on track to receive large payouts if the merger goes through. Time Warner Cable’s chief financial officer will receive $27 million, Michael L. LaJoie, the company’s Chief Technology Officer, will get $16.3 million, and Philip G. Meeks, the company’s COO, will receive $11.7 million.

The record for a “golden parachute” payout is currently held by former General Electric CEO John Welch, who got $417 million when he left the company. Other executives who received notable “golden parachute” payouts include former Exxon Mobil head Lee R. Raymond, who got $321 million when he left the company in 2005, and William McGuire, who got $286 million when he left UnitedHealth Group eight years ago.

Last year, Heinz CEO William Johnson received $212.6 after agreeing to a $28 billion buyout deal with Berkshire Hathaway and 3G Capital.

According to a Bloomberg survey released in June, there are more than a dozen executives of companies listed on the Standard & Poor’s 500 Stock Index who stand to get more than $100 million if they are fired, in many cases dwarfing their already enormous annual salaries.

In fact, three of those executives would get nearly a quarter billion dollars if they were fired. John Hammergren, CEO of McKesson Corp, stands to receive 303.4 million, Les Moonves, CEO of CBS Corporation, would get $251.4 million, and David Zaslav of Discovery Communications Inc. stands to receive $224.7 million.

The deal between Comcast and Time Warner, the largest and second-largest cable companies in the US, would create an enormous cable monopoly that would control over one third of the cable television and broadband Internet markets in the United States. The deal was announced February 13, and would be valued at $45 billion. Neil Smit, the current CEO of Comcast, would run the combined company following the merger.

In June 2013, the New York Times reported that the 200 highest paid CEOs at US public companies with revenue above $1 billion received a median compensation package of $15.1 million in 2012, 16 percent higher than the previous year. At the top of the list was Oracle CEO Lawrence Ellison, who received $96.2 million, an increase of 22 percent over 2011.

While total CEO pay figures are not yet available for 2013, the pay of individual CEOs grew significantly last year, particularly in the financial sector.

JPMorgan Chase CEO Jamie Dimon has been awarded $20 million in pay for 2013, an increase of 74 percent from the previous year, even after the bank agreed to pay $20 billion in legal settlements. Goldman Sachs CEO Lloyd Blankfein received a $26 million bonus in 2013, his highest since the 2008 crash.

The average bonus payout for Wall Street employees grew by 15 percent in 2013, hitting the highest level since the 2008 financial crash, according to figures released earlier this month. The average employee bonus grew to $164,530 in 2013, the third-highest figure on record, and the total cash bonus pool for Wall Street hit $26.7 billion.

Meanwhile the wealth of the world’s super-rich continues to skyrocket amid the continual run-up in stock prices. The combined net worth of the world’s billionaires has doubled since 2009, according to a 2013 report by Wealth-X.

The author is a senior political commentator with wsws.org, educational arm of the Social Equality Party.