By SickofStupid

If you’re one of the estimated 14 million American homeowners stuck with negative home equity or struggling to make your mortgage payments, you may have cheered the recent news of a national mortgage foreclosure settlement,thinking that help has finally arrived. And it has…kind of. Unfortunately, it probably won’t help you.

In an attempt to make voters believe it can be “tough” on Wall Street, the Obama administration is promoting the approximately $25 billion national mortgage foreclosure settlement between the attorneys general of 49 states and the nation’s five largest banks as a significant accomplishment. The settlement is purported to provide substantial help for homeowners, while holding banks accountable for their past crimes related to the mortgage crisis and preventing similar illegal actions in future. In reality, the settlement is nothing more than an election year publicity stunt, savings and opportunities for investors and a “get out of jail really, really cheap” card for Wells Fargo, Citigroup, Ally Financial/GMAC, JP Morgan Chase and Bank of America [BofA].

The need for mortgage relief is clear. An estimated 12.5% of all outstanding U.S. mortgages, or 6.25 million, are in default or foreclosure. 11 million homeowners are underwater, totaling $750 billion in negative equity alone. More than 1 out of every 10 mortgages is in default or foreclosure; 1 out of every 5 mortgages is worth less than the homeowner owes. On average, those homeowners who are underwater owe $65,000 more on their mortgages than their home is worth. Since 2007, 4 million families have lost their homes, and foreclosures for 2012 are estimated to exceed 1 million. Since 2006, home prices across the nation have dropped by an average 30%, and by a whopping 40% in Nevada, Florida, California and Arizona; homeowners have lost an astounding $7.3 trillion in home equity. Home prices decreased around 4% last year, and Fannie Mae’s chief economist, Doug Duncan, estimates that home prices could drop an additional 7% in 2012.

The need for mortgage relief is clear. An estimated 12.5% of all outstanding U.S. mortgages, or 6.25 million, are in default or foreclosure. 11 million homeowners are underwater, totaling $750 billion in negative equity alone. More than 1 out of every 10 mortgages is in default or foreclosure; 1 out of every 5 mortgages is worth less than the homeowner owes. On average, those homeowners who are underwater owe $65,000 more on their mortgages than their home is worth. Since 2007, 4 million families have lost their homes, and foreclosures for 2012 are estimated to exceed 1 million. Since 2006, home prices across the nation have dropped by an average 30%, and by a whopping 40% in Nevada, Florida, California and Arizona; homeowners have lost an astounding $7.3 trillion in home equity. Home prices decreased around 4% last year, and Fannie Mae’s chief economist, Doug Duncan, estimates that home prices could drop an additional 7% in 2012.

There’s evidence that, far from being over, or on the decline, the situation could become even worse in future. 1 in 7 Nevada residents who purchased homes between 2004-2008 are at least 60 days in default, or are in foreclosure; this is nearly equal to the amount of Nevada homeowners who have already been foreclosed on. Florida’s statistics are even more dire.

In addition to the obvious negative statistics, political considerations demand action in an election year. The mortgage crisis is at its worst so far in the major swing states of Nevada, Florida and Michigan; foreclosure rates are also high in battleground states like Virginia, Michigan, Indiana and North Carolina. That’s more than enough for most would-be presidential candidates to tackle the topic. But state Attorney Generals might not be as motivated to help the President of the United States [POTUS] boost his poll numbers. Under the settlement, though, states can use settlement funds for purposes other than mortgage relief to troubled homeowners, increasing both incentive and pressure for state AGs to sign on.

The perpetrators, details and negative consequences of the ongoing mortgage crisis are fairly obvious. The best possible solutions are pretty obvious, too. For these reasons, it’s all the more surprising that ANY AGs signed onto a settlement granting virtually complete immunity to banks for a crime that is arguably their most common–and most damaging–that provides such dubious and limited benefit to struggling homeowners, let alone all but one. [Oklahoma wisely declined.]

The perpetrators, details and negative consequences of the ongoing mortgage crisis are fairly obvious. The best possible solutions are pretty obvious, too. For these reasons, it’s all the more surprising that ANY AGs signed onto a settlement granting virtually complete immunity to banks for a crime that is arguably their most common–and most damaging–that provides such dubious and limited benefit to struggling homeowners, let alone all but one. [Oklahoma wisely declined.]

The settlement is expected to help only up to 2 million homeowners, whose loans are owned–or in some cases, serviced by–the five banks that are party to the settlement. The deal excludes mortgages owned by Fannie Mae and Freddy Mac, which currently represent about 60% of all outstanding mortgages in the U.S. The deal also excludes mortgages owned by banks not party to the settlement and mortgages owned by private investors. Homeowners who are current on payments and do not have negative equity don‘t qualify for relief, even if they‘re having trouble making payments. Homeowners with second mortgages are, for some reason, eligible.

Eligibility is confusing. The banks are required to notify eligible homeowners, but since homeowners won’t know whether or not they are eligible, it’s conceivable that banks could simply fail to notify them without suffering adverse consequences. Homeowners whose loans are serviced by participating banks may believe they will be eligible for relief due to confusion over who actually owns their loans, since servicing banks are not obligated to tell homeowners when their loans have been sold; to the homeowner, it would appear that they servicing bank owned their loan. News of the settlement may encourage troubled homeowners who have barely managed to keep current on payments to default in anticipation of receiving assistance; unfortunately, in most cases, that assistance would never be realized, due to the extremely narrow current scope of eligibility, paving the way to even more foreclosures and economic loss.

An administrator to oversee the settlement will not be chosen for two months; actual help to homeowners won’t even begin for an estimated six to nine months. Banks are being given three years to fully meet the terms of the settlement, which will be about three years too late for the large number of homeowners already in, or at risk of foreclosure.

The settlement places a higher priority on preventing future foreclosures than on rectifying past illegal foreclosures, which fails to hold banks accountable for their crimes. Banks would receive more credit for helping homeowners owing less than 175% the value of their home, and less credit for helping those who owe more than 175%, giving banks less incentive to help many of those homeowners who are in the most need of relief.

Principal reductions, loan modifications and refinancings will only be available to a small portion of homeowners under the terms of the settlement, as these banks only own about 7.3% of all outstanding single-family mortgages in the U.S., per Inside Mortgage Finance. This leaves 92% of American homeowners ineligible for any type of mortgage relief.

Up to $17 billion is supposed to be used for principal reduction and “other forms of loan modification”. While this may sound substantial, it’s really not. According to the New York Federal Reserve, homeowners who are underwater on their mortgages owe an average $65,000 more than their homes are worth. Even if every one of the 2 million homeowners were to receive principal reduction, their mortgages would only be reduced by about $8500 each, on average. When someone is underwater by 175% or more [or even less], subtracting $8500 from the total owed isn’t going to provide significant relief.

Only $3 billion will be used to refinance loans to reduce interest rates.

$1.5 billion will be provided to 750,000 homeowners who were foreclosed on by these five banks from September 2008 to December 2011, which amounts to a $1500-2000 pittance for each of those who wrongfully lost their homes, tens of thousands of dollars or more in mortgage payments, relocation costs, legal fees, and even stress-related medical costs. It isn’t clear whether these homeowners are included in the estimated number of homeowners assisted by the settlement.

$5 billion goes to the states and the federal government; there’s no requirement that it be used for mortgage-related relief, enforcement or prevention. Two states, including the politically torn Wisconsin, have already announced that they will be using a considerable portion–about 20%–of their state’s settlement funds to help balance state budgets rather than help homeowners desperate for relief. Additional states are expected to make similar announcements. Cleveland, who has been forced to divert funds from programs aimed at helping needy families find affordable housing to paying for the demolishing of vacant, deteriorating houses, expects to use $72 million in settlement funds to demolish deteriorating bank-owned foreclosures and other vacancies. Cleveland is suing to recoup additional taxpayer funds spent managing the bank-owned blight. The foreclosure epidemic has been hard on Ohio, a historically important state in presidential elections.

The settlement appears to remove the responsibility of handling missing, erroneous and/or fraudulent foreclosure documentation from the courts to an “independent monitor”. Fraudulent, missing or erroneous documentation would no longer be a valid defense for homeowners against wrongful foreclosure; those cases would instead be referred to the independent monitoring agency. Banks would be allowed to fix “errors” in foreclosures; this practice by the courts led to the fabrication and forgery of foreclosure documents by the banks. The banks would be exempt from civil fines stemming from these illegal foreclosure practices for up to 1% of their loans. It is unclear how the exemption would be calculated, considering that the number of outstanding mortgages held by the banks changes daily.

Bloomberg news reports that the settlement may spur a wave of home seizures, as foreclosures slowed during settlement negotiations. Home prices may continue to drop as foreclosures increase; RealtyTrac estimates that one million foreclosures will be completed in 2012, up 25% from 2011.  As home prices continue to decrease, homeowners sink even deeper underwater; the amount of equity they own in their home decreases while they continue to owe more than their homes are worth.

As home prices continue to decrease, homeowners sink even deeper underwater; the amount of equity they own in their home decreases while they continue to owe more than their homes are worth.

Previous signed settlements with banks have proven ineffective. In 2009, Nevada’s Attorney General, Catherine Cortez Masto, along with the AGs for 10 other states, signed an agreement with Bank of America over fraudulent foreclosure practices at Countrywide, the subprime mortgage lender purchased by BofA. Although the settlement required BofA to provide up to $8.4 billion in loan modifications and foreclosure relief to 400,000 customers, only $216 million of relief had been provided by 2011; in August 2011, Masto asked the courts to void the agreementso that Nevada could pursue alternate remedies on its own.

Separate from the settlement, the Federal Housing Finance Agency announced a new Fannie Mae program that would allow investors to purchase foreclosed homes in bulk to be managed as rentals in a bid to reduce their foreclosure inventory. Investors, who accounted for more than 20% of home purchases in December, are expected to take advantage of bargain prices–30 to 40 cents on the dollar– and demand for rentals, provided they can meet the $1 million net worth required by Fannie’s prequalification form. Private equity funds have already announced plans to purchase billions of dollars worth of foreclosures, and more foreclosure properties will be available at lower prices as a result of the settlement; there are nearly four times as many homes in some stage of foreclosure as there currently are in the programs’ inventory.

It’s pretty clear who the winners and losers are in this game. A big smelly turd has been polished and spun into “the largest consumer financial protection settlement in U.S. history”. A large portion of the American public will, unfortunately, see it that way, though homeowners desperately seeking assistance will soon discover differently. Once again, the homeowners have been screwed thoroughly by the banks, this time with the eager assistance of the state and federal governments. For the bargain price tag of $5 billion each [on average], banks have purchased a cheap legal solution to the sticky problems their own crimes created; most homeowners have been denied the help they so badly need, and stripped of a critical legal defense to foreclosure.

The three year time limit for terms fulfillment indicates that the government is expecting the news of the settlement to accomplish more than the settlement itself. Worse, since three years is about three years too late for millions of homeowners; since less than 10% of homeowners would be eligible for any type of settlement relief; since the type of relief most promoted in the settlement is too small to be largely effective, the entire positive impact of the settlement for homeowners may consist merely of the brief glimmer of hope experienced upon the announcement of the settlement.

The settlement provides positive conditions for investors, creating conditions under which home prices decrease even more, and foreclosures increase. This allows investors to snap up large numbers of homes at rock-bottom prices; these homes can be held and rented until prices increase.

Probably not the worst president ever—that dubious title can be disputed with contenders like George W Bush among others—but Obama is certainly the most successfully deceitful since Reagan. His snake oil is several magnitudes stronger than “Slick Willie”s.—Eds

–

But President Obama comes out best. In one fell swoop, he’s gift-wrapped tremendous savings, stabilized/increased stock prices and an escape from legal issues for the banks; supplied his Wall Street campaign contributors with promising, bargain investment opportunities; gained considerable political capital in the battleground and swing states by supplying extra cash in times of budget difficulties; convinced homeowners, gullible in their desperation, that he’s on their side; and increased his poll numbers and popular support in an election year by presenting the American people with a big polished turd that will float around for the next three years while American homeowners circle the drain.

President Obama is, perhaps, one of the greatest American politicians ever.

Which would make him one of the worst Americans ever.

ADDITIONAL REFERENCES

http://www.newyorkfed.org/newsevents/speeches/2012/dud120106.html

http://www.huffingtonpost.com/2012/02/06/foreclosure-settlement-deadline_n_1258833.html

http://www.huffingtonpost.com/2012/02/02/robo-signing-settlement_n_1251025.html

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?_r=1

http://www.responsiblelending.org/mortgage-lending/research-analysis/disparities-in-mortgage-lending-and-foreclosures-maps-data.html

http://www.huffingtonpost.com/2012/02/13/mortgage-settlement-fannie-mae-freddie-mac-principal-reductions-fhfa_n_1268887.html

_______________________________________________________________________________

¶

ADVERT PRO NOBIS

IF YOU CAN’T SEND A DONATION, NO MATTER HOW SMALL, AND YOU THINK THIS PUBLICATION IS WORTH SUPPORTING, AT LEAST HELP THE GREANVILLE POST EXPAND ITS INFLUENCE BY MENTIONING IT TO YOUR FRIENDS VIA TWEET OR OTHER SOCIAL NETWORKS! We are in a battle of communications with entrenched enemies that won’t stop until this world is destroyed and our remaining democratic rights stamped out. Only mass education and mobilization can stop this process.

It’s really up to you. Do your part while you can. •••

Donating? Use PayPal via the button below.

THANK YOU.

____________________________________________________________________________________________________

They don’t make Republicans like Herman Andersen anymore. Andersen, a Minnesota congressman, opposed moves after World War II to cut income taxes by a fixed percent “across the board.” Such cuts, he charged, conceal big giveaways to America’s rich. To save workers $45 off their taxes, Andersen asked, why must we “give our million-dollar-income friend $90,000?” A good question for New Jersey governor Chris Christie. His

They don’t make Republicans like Herman Andersen anymore. Andersen, a Minnesota congressman, opposed moves after World War II to cut income taxes by a fixed percent “across the board.” Such cuts, he charged, conceal big giveaways to America’s rich. To save workers $45 off their taxes, Andersen asked, why must we “give our million-dollar-income friend $90,000?” A good question for New Jersey governor Chris Christie. His  Billionaire David Koch is standing in the Moorish-tiled entry hall of his Florida manse, dressed in white pants and blue blazer. He’s

Billionaire David Koch is standing in the Moorish-tiled entry hall of his Florida manse, dressed in white pants and blue blazer. He’s

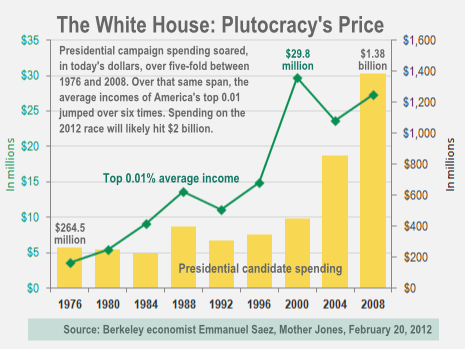

A half-century ago, President Dwight Eisenhower warned Americans against a “military-industrial complex” he saw dominating and distorting the national political scene.

A half-century ago, President Dwight Eisenhower warned Americans against a “military-industrial complex” he saw dominating and distorting the national political scene.

As home prices continue to decrease, homeowners sink even deeper underwater; the amount of equity they own in their home decreases while they continue to owe more than their homes are worth.

As home prices continue to decrease, homeowners sink even deeper underwater; the amount of equity they own in their home decreases while they continue to owe more than their homes are worth.